@lilmiquela has 1.3 million followers on Instagram. Her bio reads that she’s 19 years old, lives in Los Angeles, and supports causes including Black Lives Matter and the Innocence Project. Oh, and she’s a robot.

Her Instagram feed, which at the time of writing has 245 posts, is her entire existence. She likes memes and posting selfies. One photo in particular shows her relaxing on a lawn chair, while another has her posing on a washer/dryer set. There’s even a snap of her being tattooed by similarly Insta-famous tattoo artist Dr. Woo.

But. She’s. Not. Real. @lilmiquela is a “virtual influencer” and the brainchild of a venture capital-backed company called Brud, which describes itself as a group of “problem solvers specializing in robotics, artificial intelligence and their applications to media businesses.”

In April, @lilmiquela and Brud brought in approximately $6 million in VC funding from Sequoia, BoxGroup, SV Angel and Ludlow Ventures. It’s unclear how that money will be spent; perhaps it will go toward building out more virtual influencer accounts, some “friends” for @lilmiquela.

But the real question is why is a surreal—literally—freckly teenage girl worth millions to Silicon Valley?

After all, Brud isn’t the first company to capitalize off the platform Instagram provides, nor is it the first to illustrate how much money one can make as an “influencer.” Former “Bachelor” and “Bachelorette” contestants, each member of the Kardashian family and pretty much every C-list actor has proven that. Brud, rather, has shown that you can manufacture that influence using technology. You don’t have to pay an actual person to post an Instagram story about how he or she just “looooooves” your products.

The team at Brud decides what @lilmiquela “likes,” what she will promote on her Instagram and how she will behave online. Earlier this year, @lilmiquela posted an Instagram story advertising her partnership with Prada, undoubtedly a lucrative deal that had her advertising for the brand just in time for fashion week in February. It appeared to be one of the first official brand partnerships advertised on her feed.

Brud is hacking influencer marketing, which has already disrupted traditional advertising streams in recent years. Influencer marketing is a new opportunity stemming from that Instagram usage; it has allowed skillful bloggers, who have themselves become valuable media properties and brand assets, to make a living off social media posts. This is mostly a result of the successes of social media platforms like Twitter and Facebook, though Instagram is at the center of the influencer movement specifically.

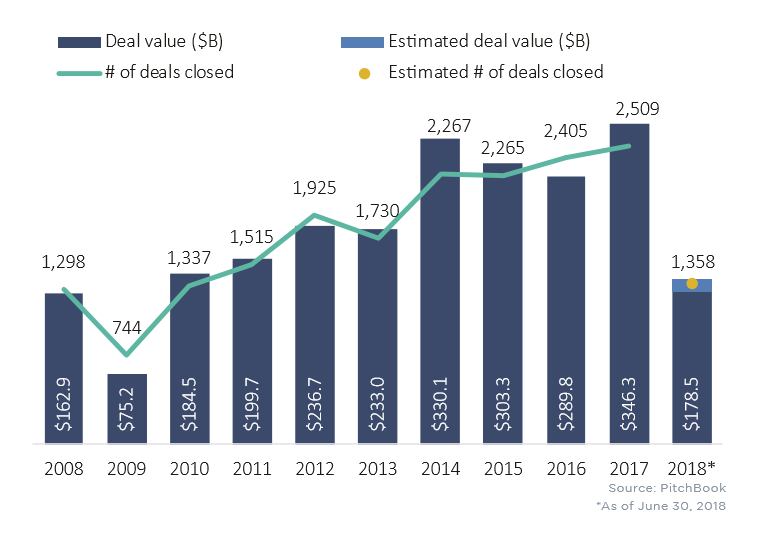

Venture capital investors, of course, were backers of all three of those platforms in their nascent days. Now, VCs are investing in a new generation of startups vying to capitalize on the innovative form of narrative advertising that is influencer marketing.

Read Full Article – www.pitchbooks.com