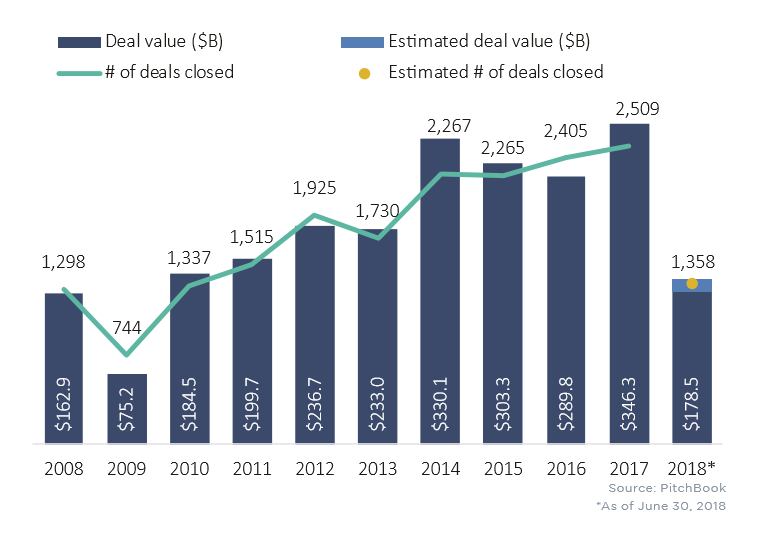

There are many themes in the US PE middle market worth discussing, but one trend we can’t ignore is its consistent strength over the years. On cue, 2018 is on pace for yet another record year for both deal counts and transaction value, coming on the heels of a blockbuster 2017. Both figures were ahead of those in 1H 2017—the 1,358 deals worth a combined $178.5 billion from 1H 2018 were 16% and 5% increases, respectively, over the same period last year, per our recent US PE Middle Market Report.

US PE middle market deal flow

If past is precedent, the back half of 2018 will be stronger than the first half, as several past years saved their best quarters for last. Going back from 2017 to 2010, fourth quarters posted the highest quarterly value totals six out of eight times, and one of those exceptions (2014) saw its best quarter in 3Q. Moreover, there’s little reason to expect a change of pace in the near-term when taking recent fundraising numbers into account. Since the start of 2010, only four quarters have seen at least $40 billion raised for middle-market-focused buyout funds in the US. Three of those four quarters have been recent (4Q 2016, 1Q 2017 and 4Q 2017), so the next two to six quarters should see high levels of investment activity as those new pools are deployed.