A Keighley-based manufacturer of precision fastener devices which sells components worldwide has been acquired by a German counterpart. £21m-turnover Glusburn Holdings, the holding company of Cirteq, has been bought by German manufacturer Titgemeyer, an international fastening and transport technology company. Cirteq operates out of a modern factory in Glusburn, near Keighley, with 215 staff and a further 55 employed via agencies. Established in the 1930s, the company went through a series of corporate ownerships, including …

IWG may launch US IPO, extending co-working space growth frenzy

International Workplace Group is considering an IPO in New York for its US-based operations, according to Sky News. Such a spinoff could reportedly be worth up to £3 billion (about $3.67 billion), nearly equal to IWG’s £3.64 billion (about $4.45 billion) market cap as of August 26. The company did not immediately respond to PitchBook’s request for comment.

The news came less than two weeks after WeWork released its S-1 document August 14, revealing 1H 2019 losses of over $900 million while holding a footprint comparable to IWG’s. As a result, IWG’s consideration of an IPO is perhaps a direct response to WeWork’s advance, evidenced by IWG’s insistence of only considering underwriters that are not involved with WeWork’s IPO, again per Sky News.

IWG isn’t the only player in this space making moves after WeWork’s S-1 reveal.

On Thursday, New York-based Industrious reeled in $80 million from Brookfield Property Partners and fitness club provider Equinox, among others. CEO Jamie Hodari expects the company to be profitable within a “few months,” according to Reuters. On Wednesday, New York-based Knotel announced it had pulled in $400 million at an over $1 billion valuation in a round led by Wafra.

Lesser-known competitors, such as The Yard, Convene, BHIVE Workspace, Alley, and The Wing, also stand to possibly beef up their game as WeWork’s IPO plays out.

Hasbro buys Peppa Pig owner Entertainment One in £3.3bn deal

The US toy company behind My Little Pony and Play-Doh has agreed to buy Peppa Pig for £3.3bn in the the latest foreign takeover of a much-loved British brand for a bargain price following the collapse in the value of the pound over fears of a no-deal Brexit.

The sale of Peppa Pig’s owner Entertainment One to Hasbro brings the total value of UK companies to fall into overseas hands in the last two months to more than £25bn. City analysts said foreign investors were finding UK businesses very attractive since Boris Johnson’s ascension to prime minister sent sterling to its lowest level against the dollar in recent years.

“It’s pretty clear that a whole raft of London investment banks are trawling the world saying, ‘Do you want to buy this in Britain?’,” Clive Black, an analyst at broker Shore Capital, said this week.

“The foreign takeovers keep on coming,” Russ Mould, the investment director at stockbroker AJ Bell, said: “Entertainment One has been seen as a bid target for a long time although all the chatter has focused on a media company being the logical suitor.”

Hong Kong’s richest family bought the 220-year-old pub and beer company Greene King this week in a £4.6bn deal. The US private equity group Advent International agreed a £4bn buyout of the UK aerospace and defence supplier Cobham last month, and the Netherlands-based Takeaway.com agreed a £5bn takeover of Just Eat.

Despite signs of a potential recession, deal maker sentiment remains optimistic

Recent news about the yield inversion will probably have an effect on investor psyche. Inversions have historically predated recessions by as many as 24 months—one lag in particular (2005-2007) also included a significant rise in the S&P. In four of the last five recessions, the lag between inversion and the start of a recession has lasted at least a year.

It’s a bit different with market corrections, which in two of five cases have begun in three months or less. Another tidbit came earlier this year from Bain & Co.’s Hugh MacArthur, who noted “only three periods historically [where] private multiples generally exceed the public average: during the ‘Barbarians at the Gate’ era of the mid-1980s, during the exuberant runup to the 2008 global financial crisis, and now.”

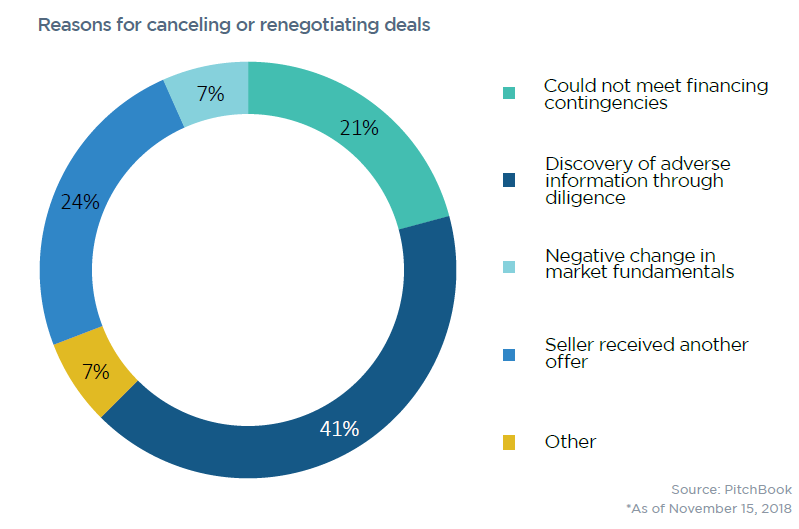

The sky has been falling for a long time among prognosticators, and the “tea leaves” in the featured chart don’t give us much of a schedule to work with. At PitchBook, we’ve been trying to gauge investor sentiment through our PE Deal Multiples Survey. In our last survey, we asked respondents for their reasons for canceling or renegotiating their most recent transactions. Here are their responses:

Those answers painted an optimistic picture among dealmakers, with only 7% citing negative changes in market fundamentals. The two most-cited responses reflect a strong market—41% said they found adverse information during due diligence and 24% said another buyer swooped in with a better offer.

Even not-that-bad information found during diligence is legitimate grounds to rethink purchase prices. There isn’t a lot of room for error with today’s multiples, and we’ve heard plenty of anecdotes of deals taking upward of 12 months to close. Furthermore, there are lots of buyers trying to put their money to work, so overcautious dealmakers will lose out to higher bidders. Those two reasons accounted for 65% of our results.

We’re curious about your thoughts as dealmakers, and our newest survey is now live. All deal data is kept confidential and isn’t published on our database. Participants receive the full aggregated report and are entered into a $300 Amazon gift card drawing—and everyone gets a candid look of current market sentiment, which may shift in the next month, or year, or two years.

CBS, Viacom enter streaming wars with $30B combination

In the latest example of major consolidation in the media industry, CBS and Viacom have officially agreed to conduct a long-awaited merger, creating a new company called ViacomCBS with a combined market cap of around $30 billion. The deal will merge CBS’s broadcast offerings and the Showtime network with MTV, Comedy Central, the Paramount film studio and other Viacom brands, adding a broad collection of new content to CBS All Access, the network’s existing streaming service.

As consumer tastes have evolved and in-home streaming has emerged as perhaps the dominant entertainment form of our time, many of the industry’s biggest players have turned to M&A to augment their offerings. It’s been a little more than a year since AT&T acquired Time Warner for $85 billion, adding brands like HBO and Turner to its stable. And earlier this year, Disney beat out Comcast to purchase a raft of TV and film assets from 21st Century Fox for approximately $71 billion, making major content additions ahead of the planned launch of its Disney+ streaming service. Disney also took control of Hulu earlier this year, valuing the streaming pioneer at $15 billion.

The newly formed ViacomCBS, though, will be considerably smaller than some of its streaming competition. AT&T and Disney both have market caps of over $240 billion, making them more than 8x the size of ViacomCBS. Netflix carries a market cap of more than $135 billion, even after its stock has slid in recent weeks in the wake of disappointing 2Q results.

The combination of Viacom and CBS has long been rumored, due largely to the very close ties between the two New York-based companies. They were in fact the same company until 2006, when media tycoon Sumner Redstone split them into two entities. Redstone and his National Amusements holding business have maintained control over both Viacom and CBS in the years since, with his daughter Shari Redstone assuming more power in recent years as her father has reportedly battled health issues.

Current Viacom president and CEO Bob Bakish will assume those same roles at the new ViacomCBS, while Joe Ianniello, the acting head of CBS, will remain in charge of CBS-branded assets. Ianniello has been the interim CEO at CBS since longtime leader Leslie Moonves stepped down last September following several allegations of sexual harassment.

G4S gears up to sell armoured van network

Security contracting firm G4S could be set to sell off its network of cash machines and armoured vans.

The firm said its board had approved plans to separate that part of its business from its main security operations, which makes up more than 80% of its business.

Nevertheless, the cash machine and money transport unit employees 30,000 staff.

G4S said it would evaluate offers for its cash arm as it continues to separate the unit from from its main security business, which it expects to have completed by the middle of next year at a cost of £50m.

Just Eat £9bn merger plan sends shares soaring

The prospect of a multibillion-pound bidding war for Just Eat sent shares in the FTSE 100-listed business surging by more than a fifth on Monday.

Just Eat agreed terms with its Dutch rival Takeaway.com in a deal that would create one of the world’s biggest online food delivery companies.

When announced, the £9bn combination valued Just Eat shares at 731p and the UK company’s share capital at £5bn.

Speculation about a rival bidder pushed Just Eat shares comfortably above the offer terms. The UK company’s shares closed up 22.7% at 780p.

Under the terms of the agreement, Just Eat shareholders would receive 0.09744 Takeaway.com shares for each Just Eat share and would own 52.2% of the combined group. It would be headquartered in Amsterdam and listed on the London Stock Exchange, with a “significant part of its operations” in the UK.

Analysts speculated there could be a counterbid, possibly from the Berlin-based Delivery Hero or the South African internet and media company Naspers.

There have been a flurry of deals in the fast-growing online food delivery market, with competition heating up from Uber Eats and Deliveroo. Just Eat bought the UK firm HungryHouse in January 2018, and in December Takeaway.com acquired Delivery Hero’s food delivery business in Germany.

Analysts at Jefferies thought the most likely counter-bidder would come from outside the industry, such as Japan’s SoftBank, Amazon or private equity.

A bid from Uber Eats or Deliveroo would raise competition issues, and these could also affect Amazon. After it became the lead investor in a $757m (£451m) financing round in Deliveroo in May, Amazon was ordered by the UK’s Competition and Markets Authority to halt any integration efforts pending an investigation into potential breaches of competition rules.

Combined, Just Eat and Takeaway.com had 360m orders worth €7.3bn in 2018 and strong positions in the UK, Germany, the Netherlands and Canada.

Under the plans, Takeaway.com’s boss, Jitse Groen, would become chief executive of the new company. It would be chaired by the Just Eat chairman, Mike Evans, while the Takeaway.com chairman, Adriaan Nühn, would be vice-chairman. The Just Eat chief financial officer, Paul Harrison, would take on the same role for the combined group, and its interim chief executive, Peter Duffy, would leave.

Groen has described the UK as one of the best three markets in Europe, along with the Netherlands and Poland. Takeaway.com was founded in 2000 and operates in 10 European countries as well as Israel and Vietnam, but it does not have a presence in the UK. The two companies have little geographical overlap apart from Switzerland.

Analysts at Barclays said: “Just Eat shareholders would be getting the best operator in the space to run the business – a notable shift from missed execution from management in the last few years.”

Just Eat has come under pressure from its activist shareholder Cat Rock Capital to merge with Takeaway.com, in which the US hedge fund also holds a stake.

London Stock Exchange agrees £22bn deal to buy Eikon-owner Refinitiv

The London Stock Exchange Group has agreed a $27bn (£22bn) deal to buy Refinitiv in a move that will transform it into a UK-headquartered, global rival to Michael Bloomberg’s financial news and data business.

The all-share deal will allow LSE to take control of Refinitiv, whose Eikon terminals on trading floors challenge those provided by Bloomberg, from a consortium led by Blackstone and including Thomson Reuters, which owns the Reuters news service.

LSEG’s shares rose 5% to £69.50 on the news of the finalisation of the deal, giving the business a stockmarket value of £24bn. LSEG’s share price has risen by more than 60% over the last year.

“The acquisition of Refinitiv is transformational,” said David Schwimmer, the chief executive of LSEG. “It is a rare and compelling opportunity to combine two world class businesses and create a global financial infrastructure leader. We will continue to be a global business headquartered in the UK.”

Schwimmer said the deal would increase its presence in the US, the world’s biggest financial market, and also allow it to expand in Asia and emerging markets.

He said that increasing LSEG’s international exposure is not a response to Brexit and that the company is prepared for a no-deal scenario.

“LSEG has been prepared for whatever may come through Brexit,” he said. “We are already diversified across regions and by currencies. This transaction helps us become more global. This is not about Brexit.”

The finance chief, David Warren, said there would be job cuts, as part of £350m of cost savings over the next five years, but would not say how many redundancies there would be.

“I can’t quantify them, it would be too early to do that,” he said. “[There will be] employee related efficiencies.”

Here are the world’s 10 largest M&A deals this year

Chevron on Friday agreed to acquire Anadarko Petroleum in a transaction valued at $47.5 billion, including equity and debt. Under the agreement, Chevron will acquire all of the outstanding shares of Anadarko for $65 a share — a 37% premium to Thursday’s closing price. Anadarko shareholders will receive a mixture of cash and stock.

Chevron is the second-largest US energy company behind Exxon Mobil and the transaction will expand the company’s capabilities in US shale oil and gas production. Many industry commentators have indicated consolidation in the fragmented sector is overdue, prompting speculation of further deal activity.

This year, 108 deals with a value of over $600 billion have been announced. North America was the most active region, however, Saudi Aramco’s $61.9 billion purchase of Saudi Basic Industries was a notable transaction outside the region. Energy deals so far this year have topped $110 billion, including both the Anadarko and the Saudi Basic Industries transactions.

Here are 10 of the largest M&A deals so far this year in ascending order of their valuation size:

Ultimate Software/Hellman & Friedman

Sector: High technology

Target name: Ultimate Software

Target nation: United States

Acquirer name: An investor group led by Hellman & Friedman

Acquirer nation: United States

Deal value net debt: $10.4 billion

Date Announced: February 4, 2019

Newmont Mining/Goldcorp

Sector: Materials

Target name: Goldcorp

Target nation: Canada

Acquirer name: Newmont Mining

Acquirer nation: United States

Deal value net debt: $12.5 billion

Date Announced: January 14

Centene/Wellcare

Sector: Healthcare

Target name: Wellcare

Target nation: United States

Acquirer name: Centene

Acquirer nation: United States

Deal value net debt: $13.5 billion

Date Announced: March 27

Read More – www.businessinsider.com

Print M&A activity shows no sign of abating

While mergers and acquisitions are nothing new in print, the latest PrintWeek Top 500 found that there were at least 77 deals involving UK printers between March 2018 and March 2019 – the busiest period in M&A activity in recent years.

And things have not slowed down since, with deals involving companies big and small still happening in nearly every corner of the industry.

Among those finalised in the past month alone include DG3’s purchase of Newnorth, Bell & Bain’s merger via acquisition of J Thomson Colour Printers, and Positive ID Labels’ double buy of Banbury Labels and Dabbon Labels.

Suppliers have also seen their fair share of action, with Japan Pulp and Paper’s acquisition earlier this month of Premier Paper Group heading up the recent moves on that front.

Hopefully all these deals will prove successful, but acquisitions can, and do, go wrong for companies that cannot financially or strategically support their ambitions or, indeed, for a myriad of other reasons.

“Acquisitions can make sense, but be wary and be very clear why it’s advantageous to your business,” warns BPIF chief executive Charles Jarrold.

“Similarly, be sure to understand the business and do your due diligence on the acquisition before finding out late in the day that things are not what you expected. I used to work for a big US company who used the term ‘deal zeal’ – the buzz of getting caught up in an exciting acquisition can impede clear judgement.”

But acquisitions are nevertheless very popular in print as the industry continues to consolidate to ease overcapacity and increasing labour and raw materials costs.

They are also far and away the most popular form of M&A activity, with true 50/50 mergers proving incredibly rare in print, the only one listed in the latest Top 500 being Bright-source’s merger with Signal, which was already its sister company to begin with.

Many acquisitions, however, are promoted as being a merger via branding, communications with clients and PR.

“Mergers ae often billed as 50/50, but the reality is that this is rare in practice,” says Jarrold.

“There isn’t room to duplicate all functions, so one team or another, or one person or another, need to lead and businesses need clear structures and management processes. There is however room for making sure that the best of each business wins through – probably not 50/50, but a dispassionate look at what’s best.”

Richmond Capital Partners director Kevin Barron says true 50/50 mergers are often a “needs must deal” that happens when two companies that cannot afford to buy each other join forces to eliminate excess capacity.

“Generally you would start a new company that acquires the two companies, then at some point there is a rationalisation that goes on but that generally takes six to 12 months to work its way through, because you can’t merge companies in five minutes.

“So you end up with duplication for a while. We knew of one company who didn’t rationalise quickly enough and ended up with four finance directors.

“And egos can get in the way with 50/50 mergers – ‘my business is better than yours’.”